Streamline Your Tax Returns with MTD for Accounting Seed: A Seamless Solution for HMRC Compliance

In the ever-evolving landscape of financial regulations, staying compliant with tax requirements is paramount for any finance department. Enter Making Tax Digital (MTD) for Accounting Seed, a game-changing solution developed by Prodigy that’s designed to simplify and streamline your tax return process while ensuring direct submission to HMRC. As an Accounting Seed user, you’re about to experience a seamless transition to digital tax filing that promises accuracy, efficiency, and peace of mind.

What is Making Tax Digital (MTD)?

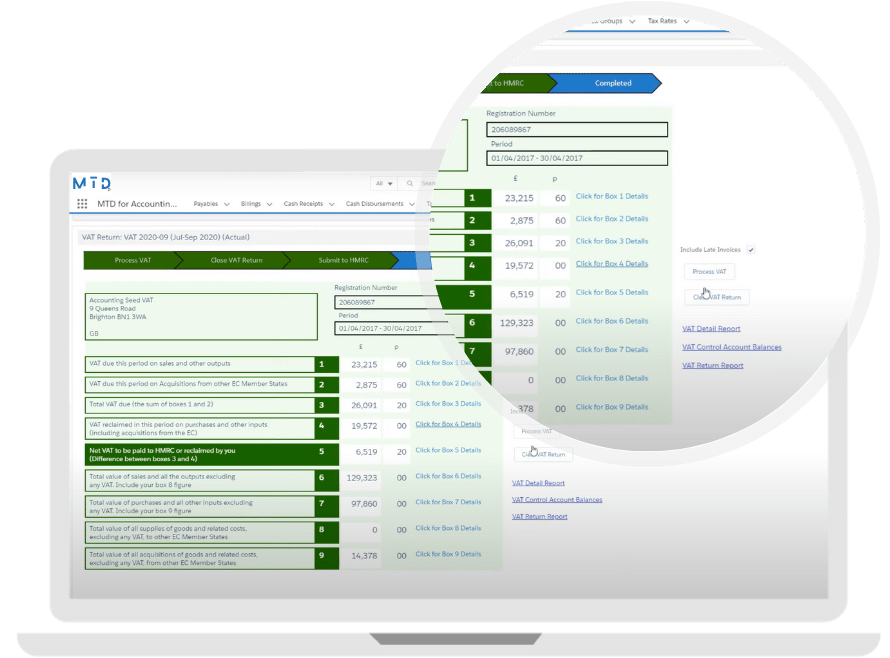

MTD is a comprehensive plugin tailored for Accounting Seed and Salesforce platforms. Born out of the 2020 initiative to digitize accounting practices, MTD tackles the challenge of electronic filing and submission of tax returns to HMRC. This initiative is a direct response to the UK’s Revenue and Customs requirement for all tax submissions to be electronically filed. MTD by Prodigy is a preconfigured extension, offering a dedicated module within Accounting Seed to ensure your VAT returns are filed correctly and on time.

Why opt for MTD?

- Effortless VAT Return Processing: Adjust, validate, and submit your VAT return directly to Revenue without the headache of manual calculations and paperwork.

- Flexible Adjustment Validation: Manual adjustments? No problem. MTD accommodates manual changes to your VAT return, ensuring accuracy.

- Direct Submission to HMRC: MTD for Accounting Seed is officially recognized by HMRC, enabling you to submit your VAT return directly to the authorities.

- Seamless Integration with Accounting Seed: Your VAT return will seamlessly post within Accounting Seed, minimizing disruption to your workflow.

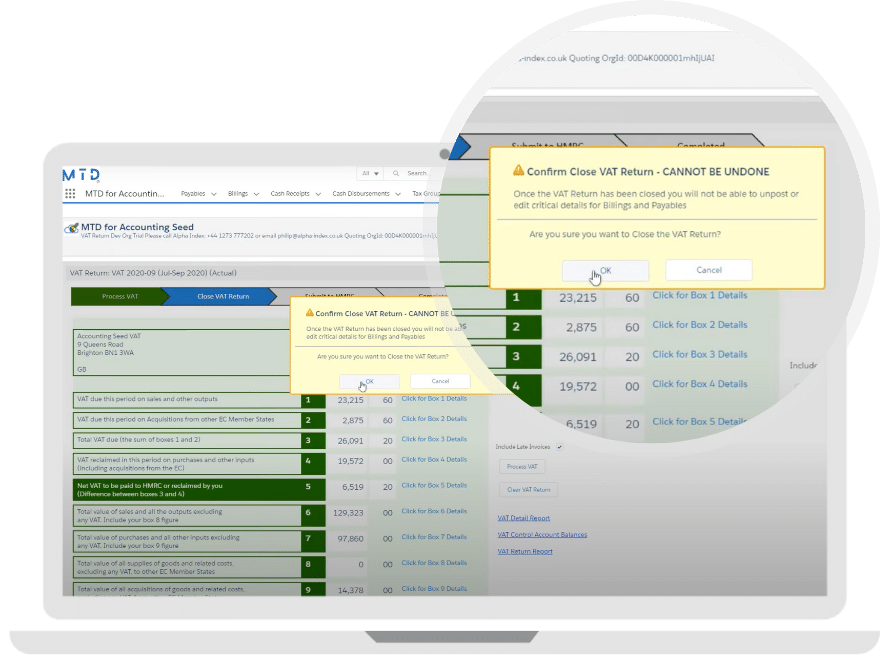

- Ironclad Compliance: Record-locking mechanisms ensure compliance with regulatory requirements, adding an extra layer of security to your submissions.

- Group VAT and Partial VAT Supported: MTD supports group and partial VAT submissions (Beta), catering to a wider range of business scenarios.

- End-to-End Support: From setup to submission, MTD guides and supports you through every step of the HMRC VAT process within Accounting Seed.

- ROS Annual Returns: MTD for Accounting Seed supports Annual Returns via the Irish Revenue Online Services – ROS.

Permission sets

Processing VAT

VAT Returns

Getting Started is a Breeze

Embarking on the MTD journey takes just five simple steps:

- Package Installation: Get your admin to install the managed package and allocate the necessary permission sets.

- Setting VAT Periods: Define your VAT periods and return frequency to align with your business operations.

- Accounting Seed Setup: Configure ‘Header Level Posting’ and ‘Native Tax’ settings in Accounting Seed.

- General Ledger Accounts: Set up specific general ledger accounts for sales tax control, purchase tax control, VAT liability, and VAT adjustments.

- Creating Your VAT Return: With everything in place, you’re ready to create and submit your first VAT return hassle-free.

Global Outlook with Multi-Currency Support

MTD for Accounting Seed goes beyond borders, supporting international accounting needs like multi-currency and consolidation. No matter where your business operates, MTD ensures your tax compliance journey is seamless and globally relevant.

Validating Returns Made Easy

Value Added Tax (VAT) is a familiar concept for businesses worldwide, and MTD for Accounting Seed streamlines its processing and validation. Add VAT to your sales and reclaim it on purchases – MTD simplifies the process while ensuring accuracy.

Unlocking Real-Time Insights

MTD empowers your finance and accounting teams with data-driven reporting. Cloud-based solutions mean easy access to accurate and comprehensive reporting features and dashboards, providing a 360-degree view of business activity and revenue for informed decision-making.

MTD for Accounting Seed is your ally in the ever-changing landscape of tax regulations. This technology-backed solution simplifies VAT return processing, ensures compliance, and grants you the confidence of timely and accurate submissions to HMRC. With MTD, you’re not just adapting to change – you’re embracing it and streamlining your tax affairs for a more efficient financial future.

Ready to simplify tax compliance and ensure accurate submissions?

Contact Prodigy now to harness the power of MTD for Accounting Seed and streamline your financial future.