Making Tax Digital

MTD for Accounting Seed

Providing a full Digital Journey UK VAT

MTD by Prodigy is a preconfigured extension containing a module for Accounting Seed.

Making Tax Digital was a 2020 initiative to digitise the accounting process including filing submission of returns to the UK’s Revenue and Customs – HMRC. All tax submissions have to be filed electronically in the U.K. Our MTD solution gives peace of mind that your VAT return will be filed on time and correctly.

MTD for Accounting Seed also supports Annual Returns via the Irish Revenue Online Services – ROS.

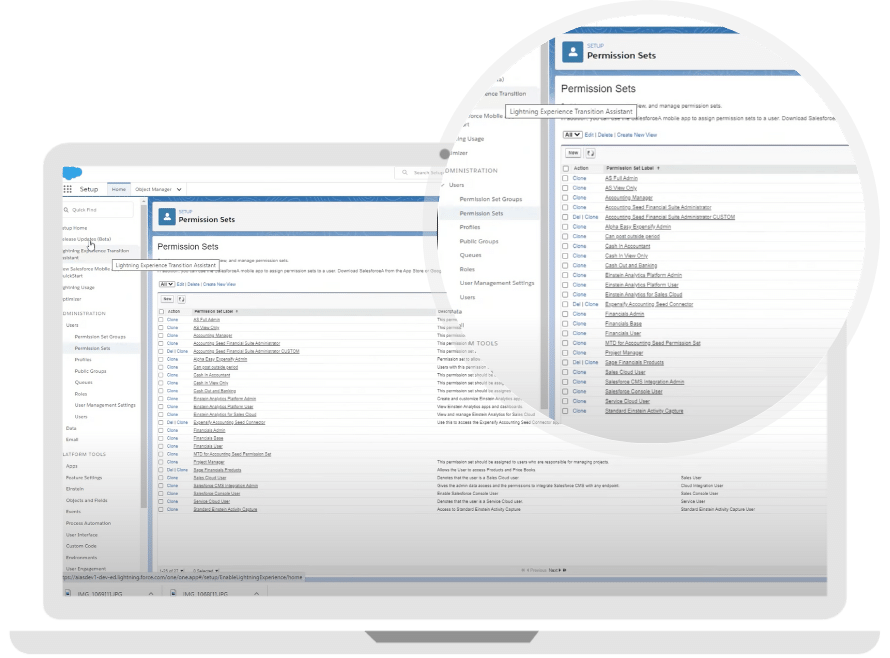

Easy to install and configure

5 steps to creating your first VAT return

- Get an admin to install the managed package, and allocate permission sets

- Identify the VAT periods end and VAT return frequency

- In Accounting Seed, set up ‘Header Level Posting’ and ‘Native Tax’

- Set up general ledger accounts for Sales tex control, purchase tax control, VAT liability and VAT adjustments

- Create the first VAT Return

International Accounting

Multi-currency/consolidation

Making Tax Digital for Accounting Seed is designed and built to handle international accounting (multi-currency/consolidation).

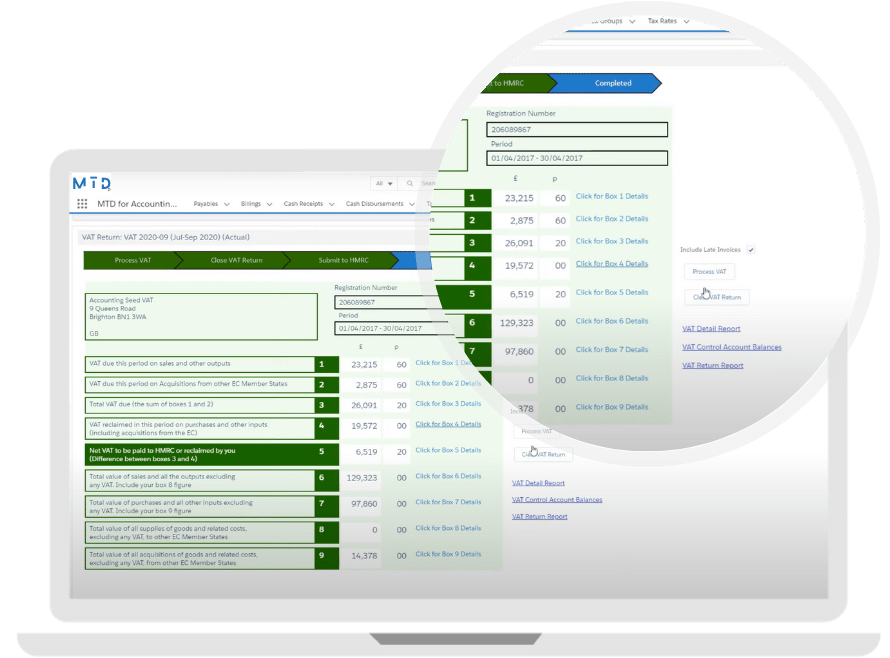

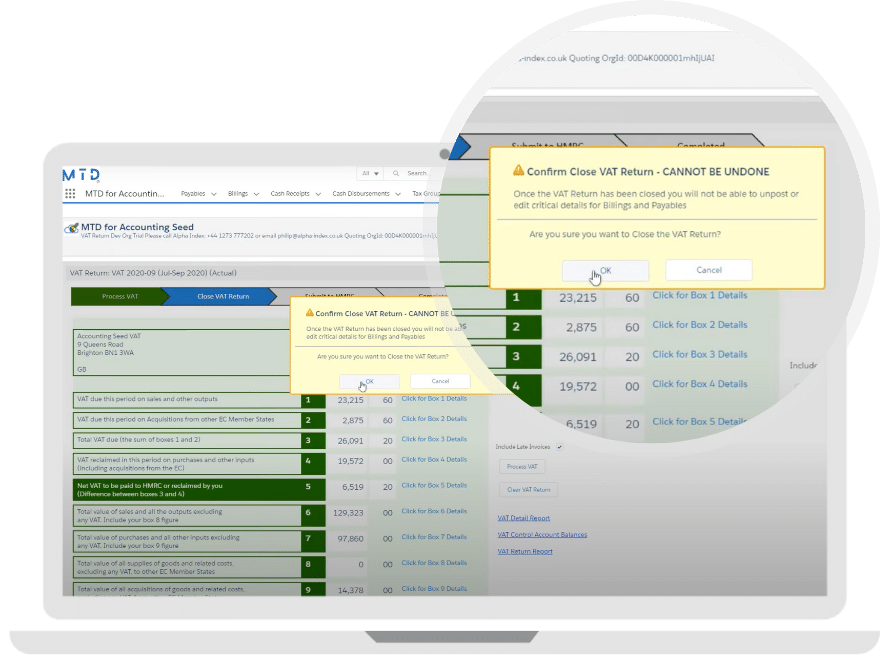

Validating Return

Process and validate vat return - adjust and submit to revenue

Value Added Tax (VAT) is used in most countries with the notable exception of the USA. It does go under various names; GST, IVA etc, but they are they are all work broadly the same. The key concept is that if your business is registered for VAT you add VAT to your sales, and can claim back the VAT you pay on purchases.

MTD for accounting seed enables you to process and validate your VAT return, adjust and submit to revenue

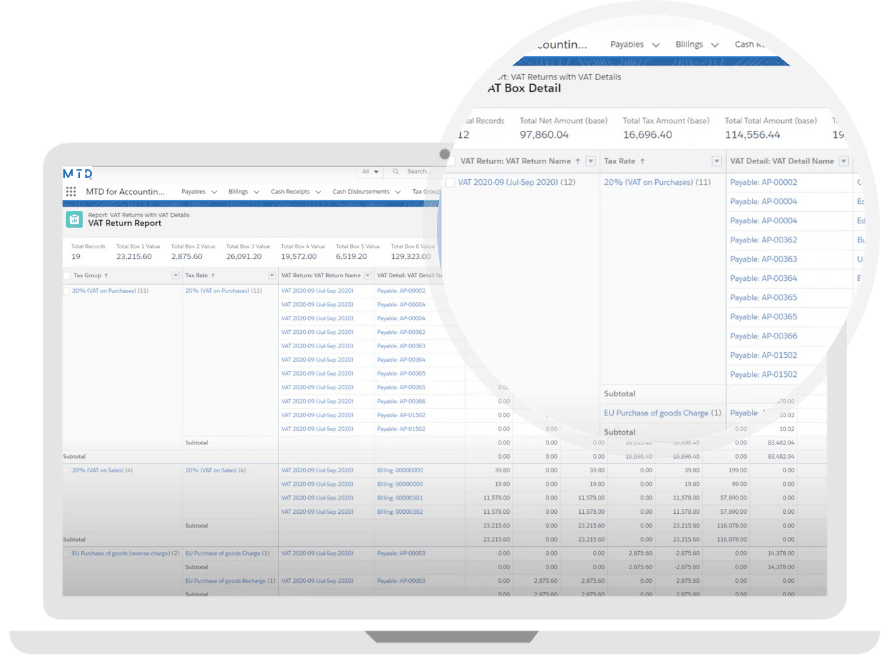

Data-driven reporting

Intelligent decision making based on realtime insights

Making Tax Digital for Accounting Seed empowers finance and accounting to easily manage tax affairs.

Moving to cloud based solutions allows for reporting features and dashboards which are easily accessible, accurate and complete.

Owners and managers benefit from access to a full 360 degree view of business activity and associated revenue.